The U.S. power sector is entering one of its most dramatic transitions in decades — and a new industry outlook makes the trend impossible to ignore. Deloitte’s latest Power & Utilities Industry Outlook highlights a simple but powerful reality: most of the new power plants being added to the grid are not the same type we’re losing.

And that mismatch is creating what many are now calling a “reliability gap.”

A Wave of Retirements — and a Very Different Wave of Additions

Across the country, traditional “firm” generating units — the old-school plants that can run around the clock, such as coal and certain gas units — are retiring faster than ever. Meanwhile, almost all new electric-generation capacity being built is renewables and battery storage.

This shift is great news from a decarbonization perspective, but it also introduces a challenge: renewables and storage don’t yet behave like firm baseload. They produce power, but not always exactly when it’s needed. Storage helps, but today’s fleet still isn’t big enough to provide the same around-the-clock reliability as the plants heading for retirement.

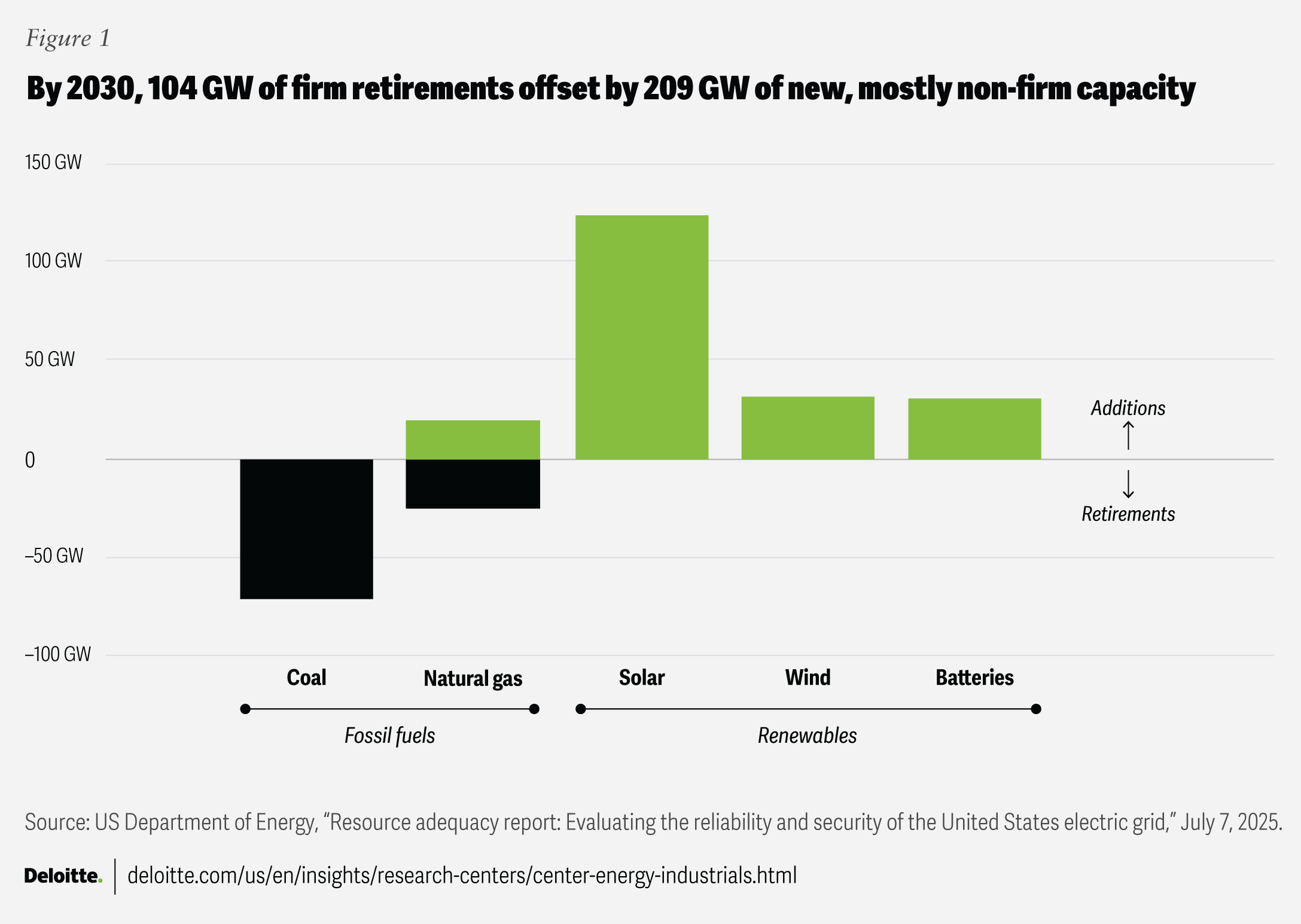

Figure 1: Retirements of conventional firm generation vs new-build additions (source: Deloitte 2026 Power & Utilities Industry Outlook).

The Chart That Says It All

Deloitte’s Figure 1 drives this home vividly. On one side: large, steady blocks of retiring coal and older gas plants. On the other: new additions dominated by solar, wind, and batteries.

What’s missing?

Firm, dependable replacement capacity.

Only a small sliver of new projects fall into the “always-available” category — and that’s the heart of the reliability gap. As older baseload plants shut down, the grid is losing resources that utilities have relied on for decades to meet demand in all weather, across all seasons.

Coal’s Days Are Clearly Numbered

If you need a single image to understand the direction of the U.S. electricity system, that figure is it. Coal’s future on the grid is shrinking rapidly. Renewables and storage are not just joining the mix — they’re dominating it.

The question is no longer if the shift will happen, but how to maintain reliability while it does.

What This Means for the Grid

The takeaway is not that renewables are a problem — far from it. They’re now the economic leaders for new generation, and storage technology is improving quickly. But the pace of baseload retirements compared to firm replacements means grid planners must be more strategic than ever.

The challenge ahead is balancing three forces at once:

Rising electricity demand driven by AI, electrification, and data centres

Declining firm capacity as coal and aging gas units retire

A surge in variable generation from renewables

That’s the reliability gap — and it will define power-sector planning for the next decade.

Challenges and Opportunities for Every Player in the Market

This transition isn’t just a technical challenge — it’s a huge commercial opportunity. A wide range of market participants stand to play major roles:

Utilities navigating resource adequacy, grid modernisation, and investment planning

IPP developers pushing new renewables, hybrid storage, and flexible generation

Transmission operators needing to connect vast new capacity and ease congestion

Data centre operators seeking firm, clean, scalable power

Industrial customers electrifying operations and hunting for long-term reliability

Investors looking for bankable energy assets in a shifting risk landscape

Technology and storage providers enabling flexibility and firming capability

Policy and regulatory bodies reshaping market design, incentives, and reliability standards

For all of these stakeholders, the transition brings both risk and opportunity — and the winners will be those who act early and act smart.

Full Stack Energy: Let’s Build What Comes Next

At Full Stack Energy, this is exactly where we are focused in the U.S. market: helping organisations navigate the reliability transition with clarity, confidence, and a strategy that matches the speed of change.

Whether you’re a utility planning your future fleet, a developer evaluating new technologies, a data-heavy organisation seeking dependable clean power, or an investor trying to understand where the market is moving: