The clean energy initiatives are projected to take greenhouse gas emissions at 37-41% below 2005 levels and make significant progress towards achieving the 2030 U.S. NDC of 50-52% below 2005 GHG emissions.

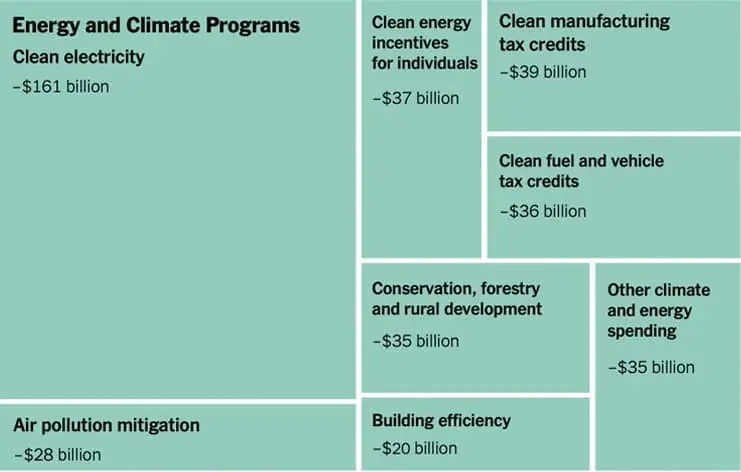

In addition to the $369 billion in funding, the Inflation Reduction Act provides $70 billion in new funds to the Department of Energy (DOE) Loan Program Office (LPO).

Extending Tax Credits for Public & Private Investment

Historically the renewable energy industry availed of tax credits and benefits in the form of production tax credits (PTCs) and investment tax credits (ITCs). Prior to the Inflation Reduction Act, the tax credits were in the process of winding down. The clean energy industry has been waiting for years to see if the Biden Administration would gather majority support to pass an extension of the existing tax credits.

The IRA enables a direct payment instead of tax credits for tax-exempt entities. This opens renewable energy investment opportunities beyond private ownership to cities, municipal utilities, rural electrical cooperatives, counties, school districts and Indian tribal governments.

Incentives are earmarked for manufacturing and innovation of clean energy technology in the United States. The largest share of the funding goes to tax credits and rebates for a host of renewable technologies — solar panels, wind turbines, energy efficiency, and electric vehicles. The Inflation reduction act also funds energy efficiency and air pollution mitigation at industrial facilities.

EV Vehicles

The IRA provides tax credits for vehicles and charging stations. Eligible vehicles are required to have final assembly carried out in North America. Vehicles are entitled to a $7,500 credit amount - the vehicle will qualify for a $3,750 tax credit if it meets a “critical materials” requirement and another $3,750 if it meets a “battery component” requirement. Larger credits apply to long-haul commercial vehicles.

EV Charging

The IRA reestablishes a lapsed Tax Credit for alternative refuelling property, such as electric or hydrogen charging stations - equal to a maximum of 30% of the equipment cost subject to a $100,000 per station limit. Bidirectional charging equipment also qualifies for the above subsidies.

Bidirectional charging allows energy to flow in and out of your car. The EV bidirectional subsidies will encourage the sale of excess energy back to the grid, aid grid stability, enable users to save money by leveraging differential energy tariffs and allow users to become energy self-sufficient by connecting onsite renewables. This could enable Vehicle to Grid (V2G) or Vehicle to Home (V2H).

EV CHARGE CONTROL

FULL STACK ENERGY HAS DEVELOPED EV CHARGE CONTROLS FOR LARGE LOGISTICS CUSTOMERS.

A global client with a large EV logistics park co-located with a sorting and dispatch centre needed to balance the requirement to charge their electric light commercial vehicle fleet (ELCV) while ensuring that they did not exceed their supplier connection agreement for total site load.

Energy Storage

The Act now provides an Investment Tax Credit (ITC) for energy storage projects. The storage project must have a nameplate capacity of at least 5 kWh and be capable of receiving, storing and delivering electrical energy. Other storage technologies, such as thermal and hydrogen storage projects, qualify under the new provision.

Department of Energy (DOE)

Loan Program Office (LPO)

$40 Billion Loan Guarantee Program

The LPO finances large-scale energy infrastructure projects in the United States and currently administers $40 billion in loans and loan guarantees for new energy technologies, including fossil as well as renewable, storage, transmission, transportation of fuels or any number of energy infrastructure projects.

The IRA provides an additional $40 billion in funding to the LPO's Title XVII Loan Guarantee Program to support U.S. energy infrastructure development and innovative clean, renewable energy generation.

$5 Billion Energy Infrastructure

In addition to the $40 billion in loan guarantees for clean energy programs, the IRA also amends the Loan Guarantee Program by adding additional support of $5 billion for Energy Infrastructure Reinvestment. The IRA amendment authorizes the DOE Secretary to make guarantees, including refinancing, for projects that “[(a)](1) retool, repower, repurpose, or replace energy infrastructure that has ceased operations; or [(a)](2) enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or anthropogenic emissions of greenhouse gases.”

For the purposes of this section, energy infrastructure is defined as “a facility, and associated equipment, used for (1) the generation or transmission of electric energy; or (2) the production, processing, and delivery of fossil fuels, fuels derived from petroleum, or petrochemical feedstocks.”

Further, a project under subsection “(a)(1) that involves electricity generation through the use of fossil fuels shall be required to have controls or technologies to avoid, reduce, utilize, or sequester air pollutants and anthropogenic emissions of greenhouse gases.”

GRID SUPPORT

DEVELOPING Grid Frequency Support WITH BATTERIES for A Multinational utility

A multinational energy utility approached Full Stack Energy to help develop a suite of software and hardware that allows the customer to provide grid frequency support by dispatching distributed batteries. It incorporates PMU technology that monitors the grid frequency per cycle basis and sends charge/discharge signals to the relevant battery banks if a frequency event is detected.

Energy Efficiency Programs

Under the IRA, the maximum allowable benefit for the Energy Efficient Buildings Tax Deduction will expand from $1.88 per square foot to $5.00 per square foot. The deduction allows partial compliance through fractional deductions. The deduction is a tiered system of energy-use reductions. To be fully compliant, buildings must reduce the energy and power cost of interior lighting, HVAC and hot-water systems by 50% or more.

$20 Billion Tribal Energy Loan Guarantee Programs

The authorized capacity to make loans to finance energy projects for Indian tribes increased from $2 billion to $20 billion, supported by a $75 million appropriation for credit subsidy costs. Congress increased the maximum guaranteed percentage from 90% to 100%, allowing access to lower-cost financing. Since its creation in 2005, no project application has been backed.

By removing the application costs and increasing the guarantee, the program is hoped to become more attractive to tribal investment in new clean energy innovations.

$9.7 Billion Rural Electric Cooperatives

The IRA provides $9.7 billion towards financial assistance for long-term resiliency, reliability and affordability of rural electric systems for zero-emissions systems or carbon capture and storage systems, including making energy efficiency improvements to electric generation and transmission.

FULL STACK ENERGY PROVIDE EXPERIENCED ENERGY SOLUTION DEVELOPMENT SERVICES

We provide highly specialised development services and development resource augmentation to our clients. We enhance their business and help them achieve their corporate objectives by solving complex energy-related challenges by creating bespoke technology solutions.

We design and develop the most advanced bespoke technology solutions to address complex energy challenges, from designing, building and operating a grid support system to developing bespoke EV Fleet Management Systems.