Turning biogas into bigger profits.

Overview.

Project background.

Biomethane must be dried, purified and—critically—compressed before it can enter the any natural‑gas grid.

Full Stack Energy's client compressors were running at a fixed 80 % load, regardless of real‑time electricity prices or on‑site solar availability. Rising power volatility turned this into an avoidable cost centre. Our client saw an arbitrage opportunity, but needed proof - fast.

Challenges.

- Day‑ahead & intra‑day power price volatility every 15 min

- Multiple physical constraints: grid‑entry spec, gas‑quality limits, compressor duty cycles

- Disparate data sources feeding into the process - SCADA, PXE price API, on‑site PV and battery controllers.

- The need for an end‑to‑end solution—from maths to field hardware—without distracting the core team

Full Stack Energy's

Solution.

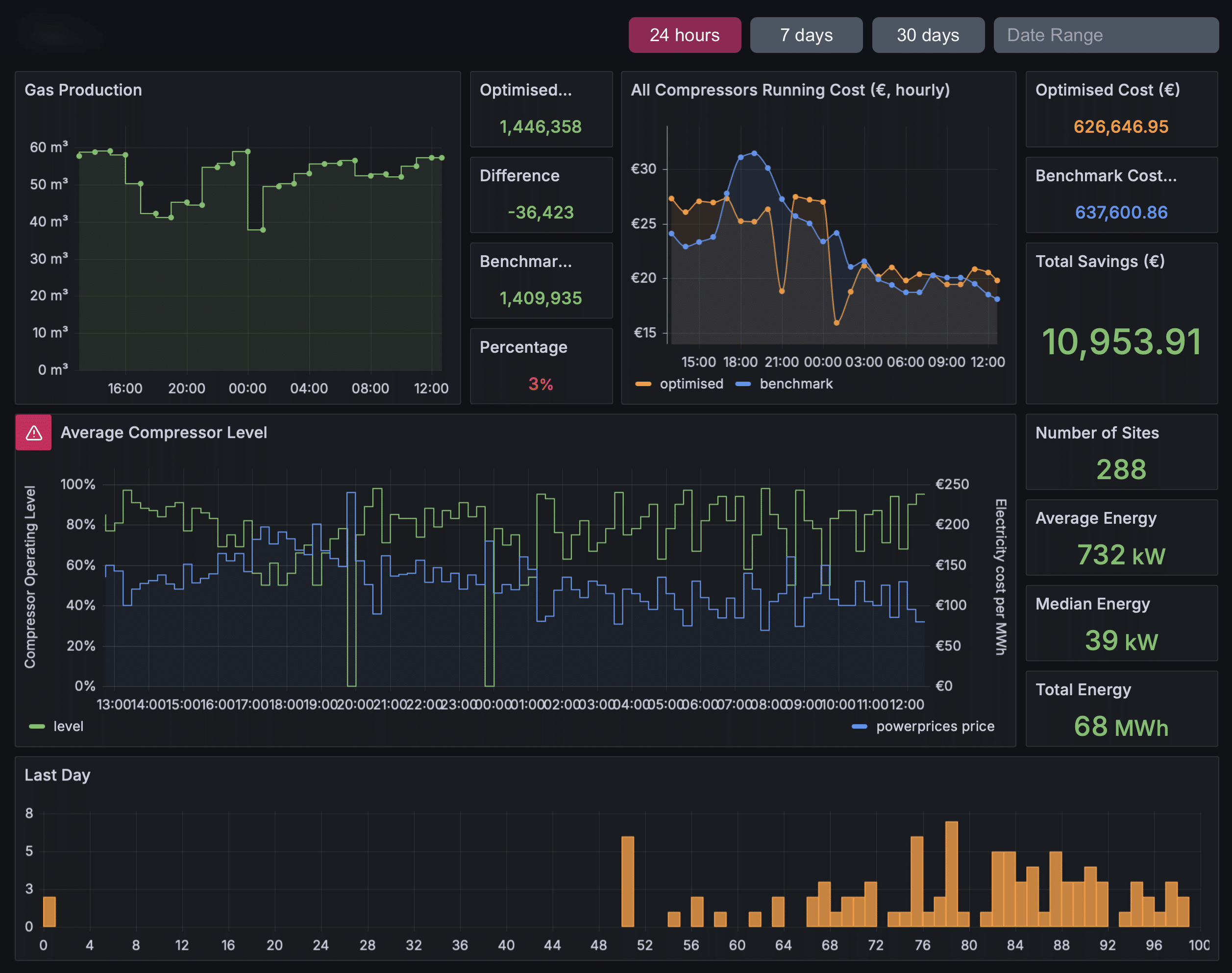

Full Stack Energy was engaged to develop the linear programming based algorithms necessary to optimise compressor usage based on wholesale electricity cost, varying on a 15m basis, whilst maintaining the same volume of biomethane production. The algorithms are designed to drive compressor operation automatically across many sites.

A more advanced prediction guided algorithm was also desired, based upon AI Machine Learning principles, for a future pathway into intraday pricing on the electricity markets.

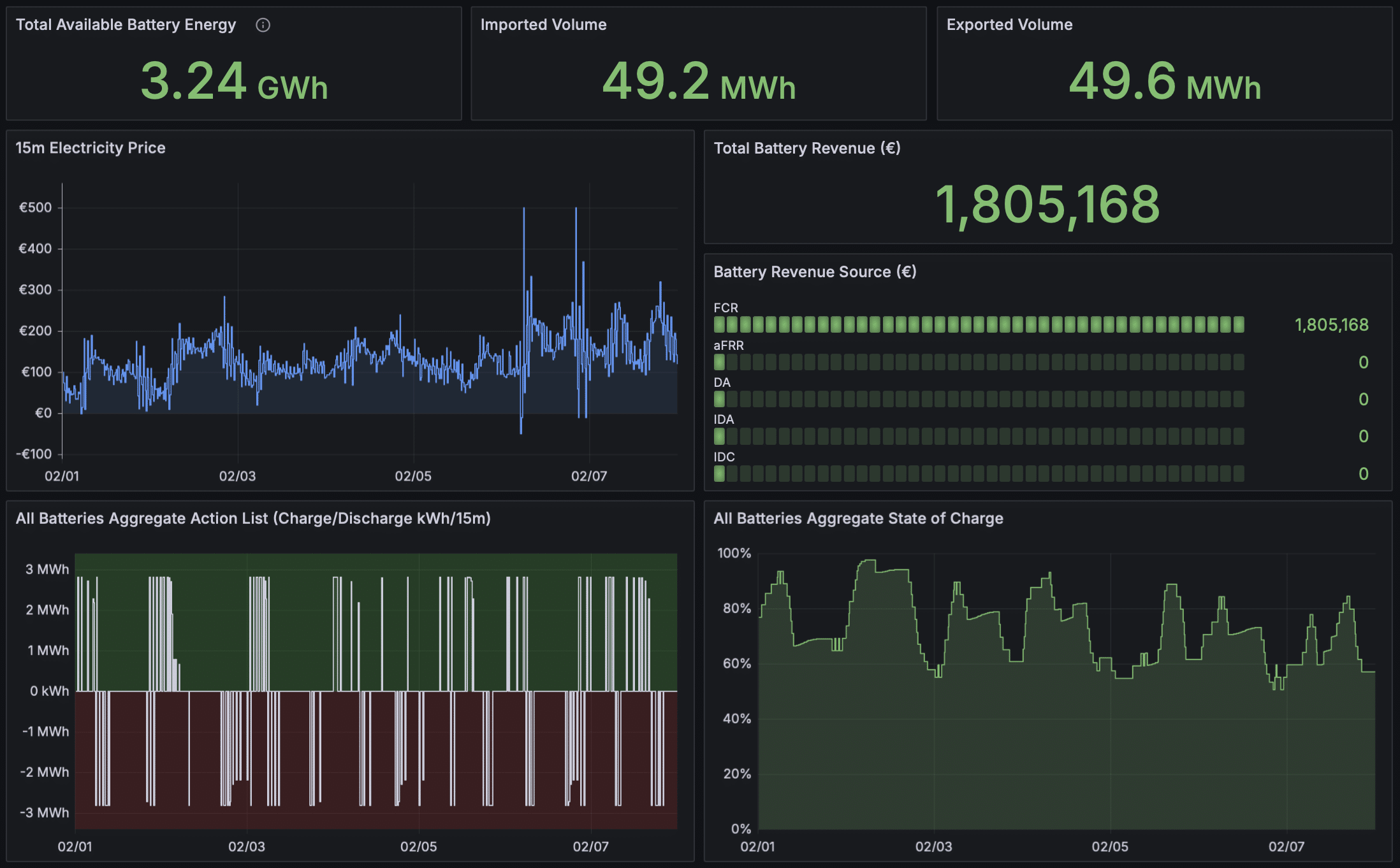

Full Stack Energy was also engaged to investigate the use of on-site Solar PV panels, and optional batteries, to support the compressor operation process and, when possible, perform a degree of battery arbitrage with the electric grid in order to generate additional profit through grid feed in tariffs.

Along with the operational algorithms outlined above, Full Stack Energy must also monitor the real time operation of compressor machinery and associated industrial plant, subsequently reporting it back to a cloud based backend where the data is stored, analysed, and made available to the client for planning, reporting, and further optimisation and planning purposes.

Key Technical Highlights:

- Modelling & Simulation: Built a physics‑accurate digital twin fed with historical PXE price curves and simulated plant data, giving the client a risk‑free sandbox to size the prize.

- Algorithm Engineering: Developed a linear‑programming optimiser that minimises € / Nm³ while guaranteeing daily offtake. Extended roadmap with ML‑driven intraday bidding.

- DER Integration: Added PV‑aware scheduling and battery arbitrage logic—avoiding exports when prices go negative and maximising self‑consumption.

- Secure IoT & Control: Hardened MQTT field gateway pushes real‑time telemetry to an AWS‑hosted InfluxDB, while encrypted control commands flow back in < 200 ms.

- Insight Portal: Custom Grafana dashboards give the client ops teams and partner farmers instant visibility, alerts and scenario planning tools.

Implementation:

Germany

Industry:

Optimisation of Biogas

Client:

Tech stack.

Database:

Cloud Software Frontend:

Cloud Software Algorithm:

Cloud Software Backend:

Cloud Platform as a Service (PaaS):

Visualisation System:

Protocols:

Data Formats:

Outcome

Impact and results

Why it matters

- Electricity cost cut—without curtailment. The optimiser shifts compressor load out of price spikes, trimming running costs while maintaining throughput.

- New revenue streams. Battery arbitrage plus negative‑price avoidance converts volatility into margin instead of expense.

- Confidence to scale. Simulated ROI convinced the client’s board to invest; the same architecture now rolls out site‑by‑site with minimal incremental effort.

- Data‑driven culture. Real‑time dashboards and forecast widgets equip client teams—and their farmer partners—with the numbers they need to plan ahead.