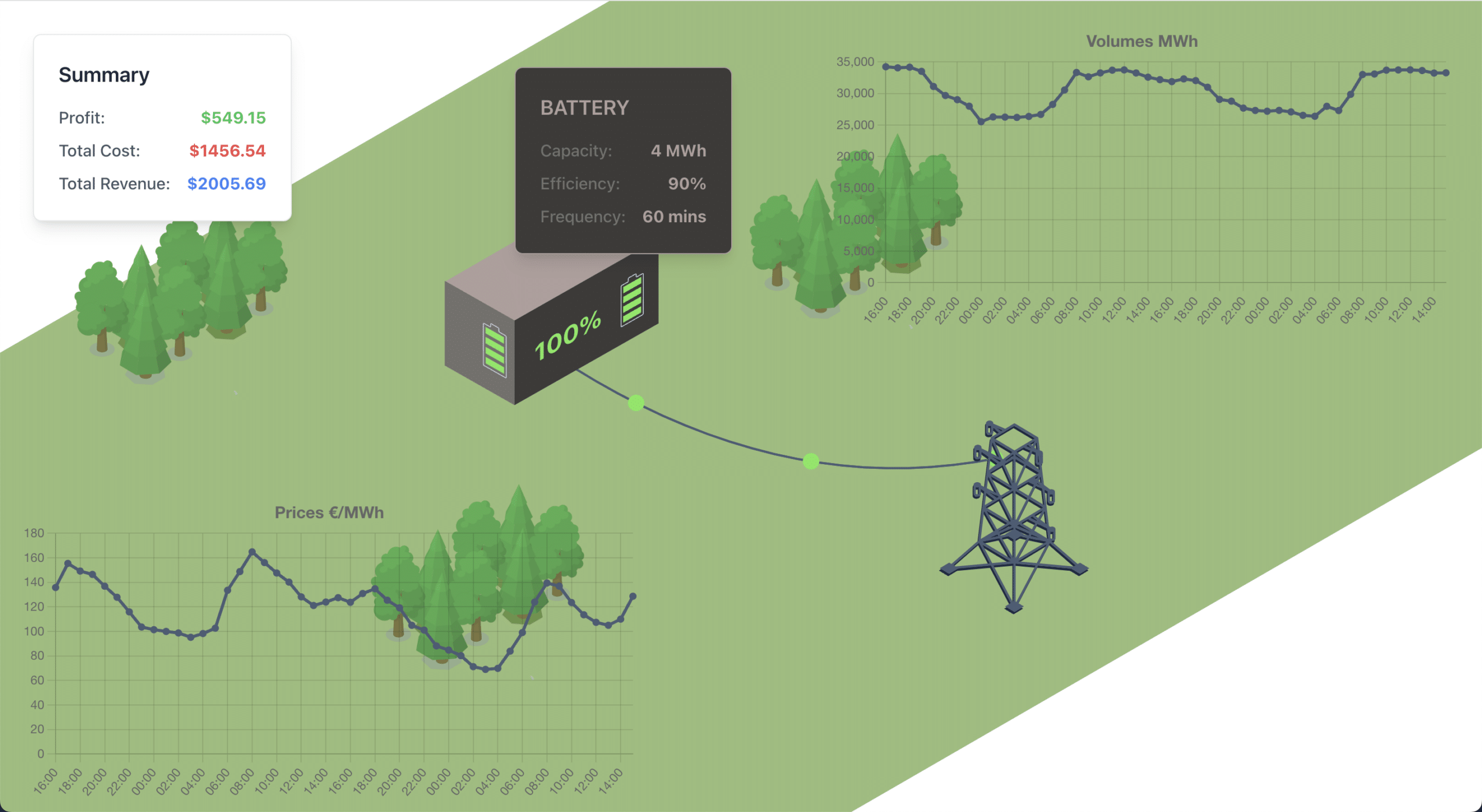

Project optimising battery usage for day-ahead electricity price arbitrage.

Project overview.

Optimising battery usage.

With the rise of renewable energy integration and fluctuating electricity prices, using battery storage for price arbitrage has emerged as a compelling use case for those seeking to reduce costs or even generate revenue.

This article outlines our live demonstration system designed to optimise battery usage based on known day-ahead electricity prices. The demonstration will highlight core concepts, but also acknowledge real-world limitations of the system in the real world.

Cloud Stack:

Python, AWS, InfluxDB

System Definition.

The system consists of a simulated grid-tied battery with defined capacity, power limits, and round-trip efficiency.

For this demonstration, the battery operates under the following parameters:

The system receives day-ahead electricity prices from the local grid operator, providing hourly price signals for the next 24-hour period. These prices serve as the primary input for decision making.

The objective is straightforward - charge the battery during low price periods and discharge during high price periods, maximising the difference between purchase and sale prices.

Capacity:

10kWh

Maximum Charge/Discharge Rate:

5kW

Round-Trip Efficiency:

90%

Solution highlights.

How the system works.

Data input.

At 5 PM each day, the system receives the day-ahead electricity price forecast. These prices typically reflect anticipated demand, generation, and grid constraints for the following day.

Optimisation algorithm.

The system runs an optimisation algorithm to identify the most cost-effective times to charge and discharge the battery during the next 24 hour period.

- Charging: The algorithm identifies hours with the lowest prices, accounting for battery constraints and efficiency losses.

- Discharging: Similarly, it identifies peak price hours where discharging the stored energy would yield the highest revenue.

- Operational Constraints: To prolong battery life, the system enforces limits on the battery state-of-charge (SOC), ensuring that the battery remains within 10%-90% SOC.

Operation.

Based on the calculated optimisation strategy, the system schedules battery actions:

- Charging occurs during identified low-price hours, until the SOC target is reached.

- Discharging is scheduled for high-price hours, again until the SOC limit is reached.

Revenue calculation.

Each kilowatt-hour discharged at peak prices generates revenue, while each kilowatt-hour consumed charging the battery also incurs a cost. The net profit is the difference between these values, adjusted for efficiency losses.

This process is executed autonomously, showcasing the potential of battery arbitrage in a well-defined pricing scenario.

The ideam vs. reality.

While the above system demonstrates the theoretical potential of battery arbitrage, it is important to recognise its practical limitations. Day-ahead electricity prices are just forecasts; real-time prices can deviate significantly due to unexpected grid events or demand surges. Moreover, intraday price signals—which are not incorporated in this model—often offer more granular opportunities for optimisation.

In real-world applications, the cost of implementing such a system, including the battery, software, and hardware integration, must also be considered. Additionally, regulatory hurdles, grid interconnection fees, and degradation costs can potentially erode profitability.

Nonetheless, this demonstration highlights the foundational principles of price arbitrage, demonstrating how a properly designed system can respond to market signals. For stakeholders in the energy sector, it underscores the importance of robust forecasting and the value of real-time optimisation for maximising returns.

This demo illustrates the elegance of theoretical modelling, whilst also inviting deeper discussions about how to refine and adapt these strategies for the complexities of real-world electricity markets.